The shadow chancellor, John McDonnell, has called for a government investigation into the use of high-cost bank loans after a report, to which Nick Stoop of Warwick Risk Management was a contributor, found local councils stand to waste up to £16bn on interest payments over the next 40 years.

Newham council is one local authority that pays more in interest rates than it receives in council tax. Photograph: Maurice Savage / Alamy/Alamy

Kalyeena Makortoff, Banking correspondent for The Guardian, Sun 25 Nov 2018 15.12 GMT

The shadow chancellor, John McDonnell, has called for a government investigation into the use of high-cost bank loans after a report found local councils stand to waste up to £16bn on interest payments over the next 40 years.

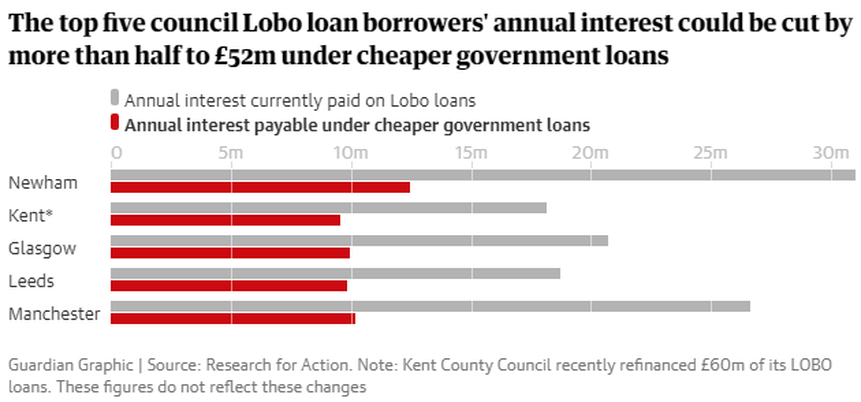

Figures compiled by the investigative cooperative Research for Action show that local governments that were saddled with complex borrowing schemes in the early 2000s could halve their annual interest payments if those debts were paid off with cash borrowed from the government’s Public Works Loan Board (PWLB).

The report explains that the top 10 council borrowers of lender option borrower option loans – knows as Lobos – stand to save as much as £4bn over the next four decades, while the 240 councils with high-interest lobo loans could collectively save up to £16n.

McDonnell has called for government action. He said: “The government has a role to play now in ensuring there is a full, independent and open investigation into the use of these financial instruments and action taken to restore any historic loss to the public purse.”

Newham council in east London borrowed the largest amount of Lobo loans, worth £563m. It is paying nearly £31m in annual interest at an average rate of 5.5%. That is more than twice the PWLB rate of 2.21%, which would cut annual interest payments to just over £18.5m. With about 51 years until those loans mature, Research for Action says the potential savings would be about £945m.

Lobos were popular among local councils in the early 2000s, as they came with teaser interest rates that kept payments low over the short-term but proved to be expensive in the long-run as those interest rates increased just as austerity and wider spending cuts took hold.

In some cases, it has left councils such as Newham paying more in interest rates than they receive in council tax, putting essential services at risk.

Lobos have also proved particularly risky because they give banks the power to raise interest rates at certain points over the loan’s lifetime – accounting for the “lender option” of the loan agreement. While borrowers have the option of rejecting those terms, this would trigger a clause forcing them to immediately repay the loan in full.

There have also been concerns over unfair penalties attached to some of these loans.

Barclays and Royal Bank of Scotland were among the largest lenders of Lobos to councils in the UK.

In 2016, Barclays scrapped Lobos by turning them into fixed-rate loans. But one of the report’s authors, Joel Benjamin, said interest payments were not necessarily affected by those changes, and only resulted in a “slight reduction” in fair value and breakage costs.

Barclays declined to comment.

RBS last month allowed Kent county council to repay a £60m Lobo loan early. The loan – which was originally taken out between 2008 and 2011 – was paid back with a lower interest and shorter-term government loan from the PWLB. However, Kent will have to shell out £13.4m in breakage fees to ditch the contract.

When asked whether the agreement with Kent county council signalled a move towards scrapping its broader Lobo loan book, an RBS spokeswoman said: “Arrangements between banks and customers are confidential but we value all our customers and are open to discussing restructuring or refinancing when circumstances change.”

Controversy has also emerged over the fact that Lobo interest rates were often dependent on Libor – the interbank lending rate that banks including Barclays and RBS have been fined for rigging.

Newham council earlier this year took steps to launch legal proceedings against Barclays as a result. It has made preliminary filings at the high court, and a full claim is expected to be lodged by the end of the year.

A spokeswoman for Newham said the council “has serious concerns regarding the mis-selling of Lobo loans and manipulation of the Libor rate by Barclays, and potentially other banks”, but was not able to comment further on legal action.

Visit The Guardian